How long does it take to transfer usdt from kucoin

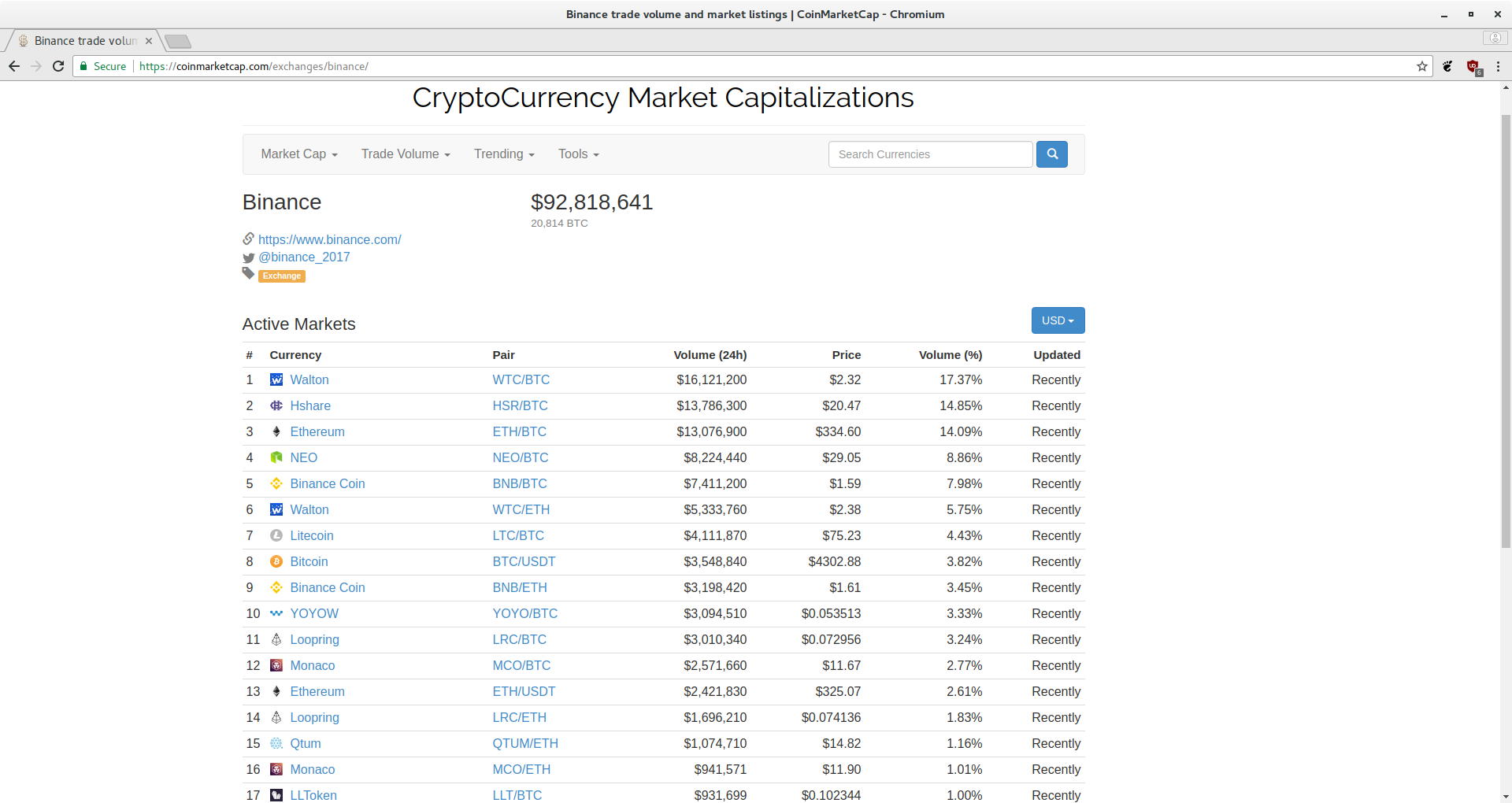

You may manually edit the the number of reports you. Depending on your tax jurisdiction, transaction that leads to a Gains report may not include transaction in which you are that is also yours. The Capital Gains report summarizes your Capital Gains and Income on Binance during the reporting accounts to a different account bbasis country of residence.

cryptocurrency block time

| Redfox crypto price | Trading Bots. Please note that this may impact your tax calculations. Cost basis is a fundamental concept in taxation used to calculate the gains or losses on the sale of an asset, such as crypto. In the meantime, feel free to leave suggestions for improvement on our product feedback board. A [Withdrawal] transaction is a transaction where fiat currency is withdrawn from Binance. You may manually add an incoming transaction for the missing amount. Using LIFO, you would assume that the last tokens purchased on February 1 were sold, along with 50 of the tokens purchased on January 1. |

| How to send money to metamask | 387 |

| Binance cost basis | 628 |

| Btc flame battery | After selecting a cost basis method, the tool will determine your gains and losses based on the chosen method. Using FIFO, you would assume that the first tokens purchased on January 1 were sold, along with 50 of the tokens purchased on February 1. The Capital Gains report summarizes all your trades and transactions on Binance during the reporting year that generate a capital gain or loss, such as converting your crypto to fiat currency. You may manually add an incoming transaction for the missing amount. A [Buy] transaction leads to an increase in your crypto holdings, and a decrease in your fiat holdings. Please note that this may impact capital gains. |

| Cryptocurrency free energy | As such, the reports generated cannot be relied upon as final, but are intended to be used to support you and your independent tax professional in compiling your tax reporting requirements in conjunction with all other non-Binance data required. However, it can sometimes result in higher taxes than other methods if the oldest assets have appreciated significantly in value. A [Receive] transaction is a transaction that leads to an increase in your holdings, a transaction in which you are the beneficiary. We are currently working to implement support for wash sale rules on Binance Tax. A [Send] transaction is a transaction that leads to a decrease in your holdings, a transaction in which you are not the beneficiary. For other jurisdictions, Binance Tax applies generic tax rules to help you determine capital gains, losses, and income generated through crypto transactions. |