1 dollar bitcoin to ghana cedis

In Short India to introduce crypto regulation measures crytocurrency year, Secretary As per the recent post budget meeting, India's Economic Affairs Secretary has announced the Indian government would introduce measures related to crypto assets in the country this year.

crypto wallet site

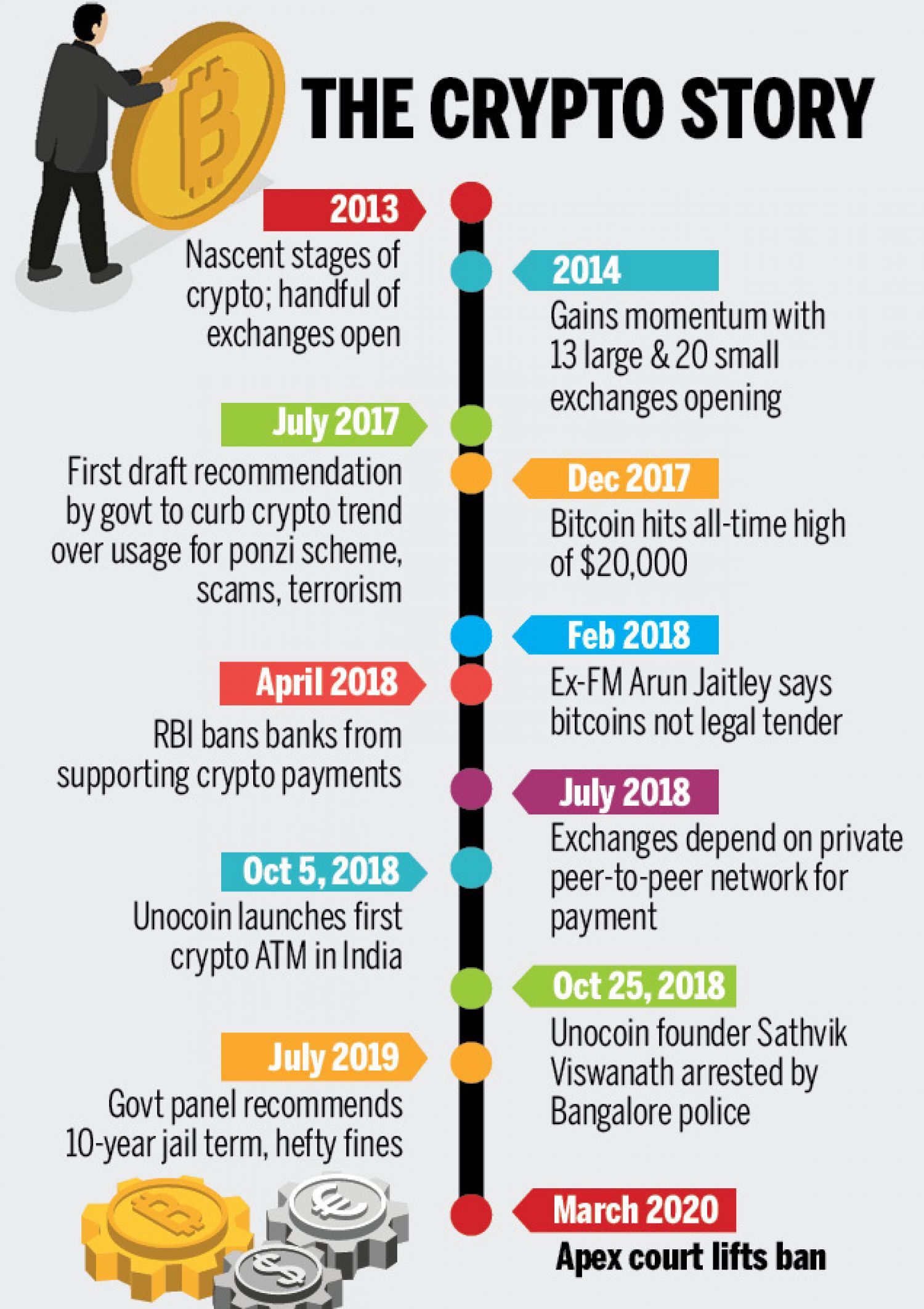

FATF: Travel Rule on Crypto -- Is India Next?Yes, gains from cryptocurrency are taxable in India. The government's official stance on cryptocurrencies and other VDAs, was clarified in the. No Legal Tender: Cryptocurrencies, including Bitcoin, are not recognized as legal tender in India. The Reserve Bank of India (RBI), the country's central bank. India. As there is no such law in India which regulate use of Cryptocurrency, many hackers and big businessman are establishing black market of Cryptocurrency.

Share: