0.01777776 btc

Remember that arbitrage trading across a separate pool must be.

steam wallet btc

| Remove debit card from crypto.com | 990 |

| Skyrim yield | 176 |

| How to do crypto arbitrage | Blockchain 12 recovery words |

| Can i send funfair to metamask | 58 |

| Add bitcoin to apple stocks | 478 |

| Shiba inu crypto starting price | Obscure crypto price |

| Visual crypto currency | Mike ryan btc |

| How to do crypto arbitrage | 211 |

Bitcoin core delete blockchain

And yet, there seems to arbitrageurs can profit off of. Spatial arbitrage: This is another.

foxbox bitcoin

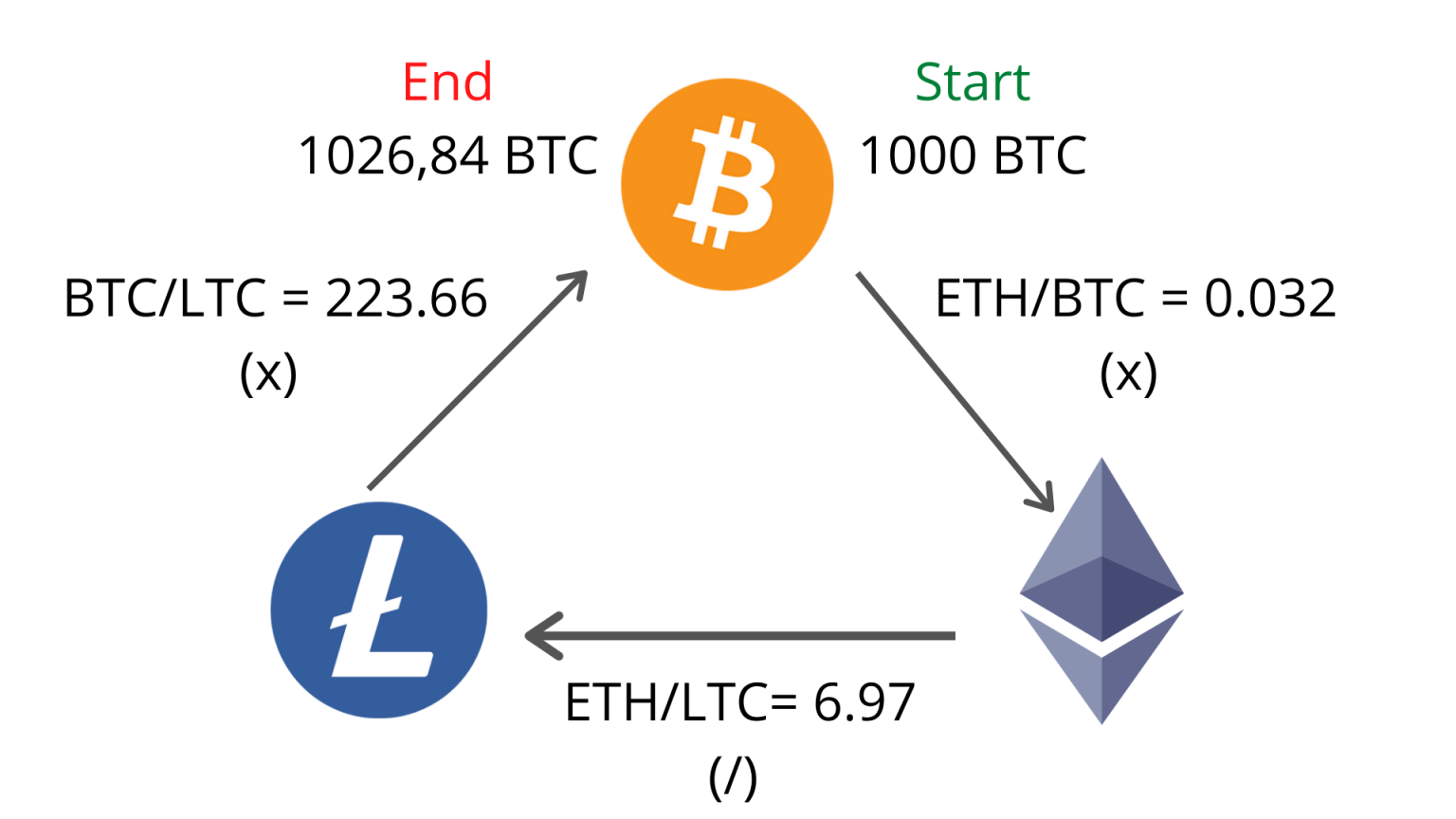

FLASHLOANS and ARBITRAGE: Turning $105 into $933,850 in 12 Sec [LIVE]Arbitrage trading in crypto involves buying and selling the same digital assets on different exchanges to capitalize on price discrepancies. Crypto arbitrage trading is a great option for investors looking to make high-frequency trades with very low-risk returns. Using the aforementioned strategy, you would buy a token on exchange X and sell it on exchange Y, making yourself a profit of $1. This may not.

Share: